Actual Wages: How to Calculate Wages for Employees Correctly

August 24, 2023

by Sony Hans

In the realm of business operations, understanding and accurately calculating actual wages is crucial. Accurately measuring actual wages is essential for assessing labor costs and evaluating your organization’s fiscal well-being.

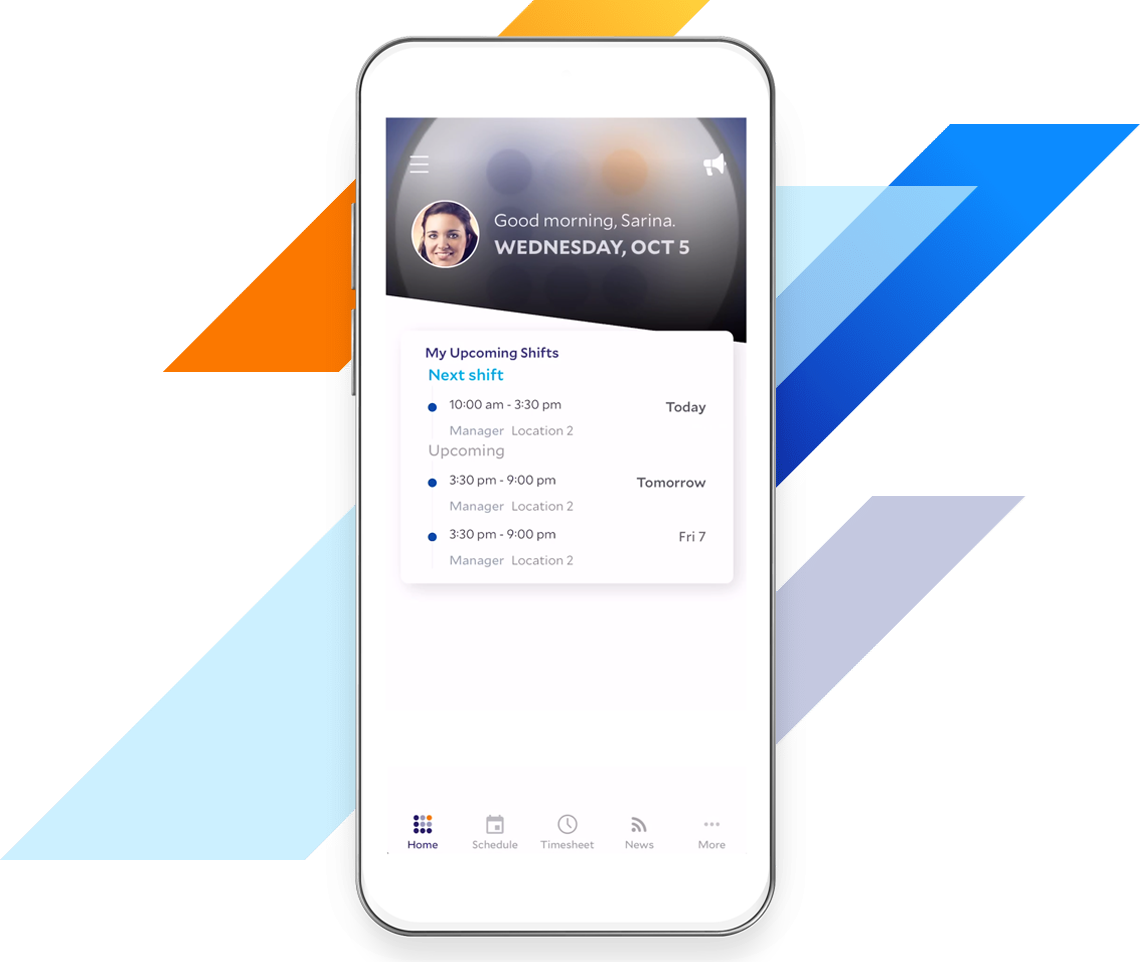

With Legion WFM’s Time and Attendance solution, you can streamline this complex process with intelligent automation. Legion Time and Attendance offers real-time insights into employee earnings by considering all relevant factors, such as overtime, bonuses, or deductions.

These real-time insights enhance transparency and aid in optimizing budgets by minimizing unnecessary expenses like overtime costs. By comparing actual versus projected costs, organizations can assess their performance against set targets and identify areas for improvement or better resource allocation.

Now, let’s dive in and help you implement this practice.

Actual Wages Definition

Actual wages are a key metric used to reflect an employee’s real-time earnings. This critical measure gives businesses a precise gauge of labor costs. It can be used to give employees visibility into their actual earnings in support of on-demand pay options.

Defining Actual Wages in Business Operations

The term ‘actual wage’ refers to what employees take home after all additions and deductions have been accounted for. It encompasses not just base salary or hourly pay but also bonuses, overtime payments, commissions, or tips—any form of compensation received by the worker.

This differs from nominal wage (the figure stated on paper) due to factors such as taxes and benefits contributions which can increase or decrease net income. Understanding this distinction is vital for employers seeking transparency about payroll expenses while ensuring fair compensation practices within their organization.

Legion Time and Attendance plays a pivotal role in calculating accurate actual wages. Automating this process makes errors less frequent, leading to more reliable data, which is crucial for budgeting purposes.

Calculating Actual Wages with Precision

In the retail industry, understanding and accurately calculating actual wages is extremely important. It’s a complex process with many factors that may change the outcome drastically.

The first step begins with an employee’s basic salary or hourly rate.

Overtime work forms another significant component to consider when determining actual wages. In dynamic sectors like retail, where shift patterns vary greatly due to fluctuating customer demand—uneven wage growth can often be attributed to these additional working hours. Labor statistics highlight how these variables influence average earnings across different industries.

Bonuses are also key contributors towards total income and can be difficult to factor into actual wages—particularly if they’re tied directly to performance metrics.

Last, tax obligations and benefit contributions need to be subtracted from gross pay before arriving at net ‘actual’ wage figures.

How Legion’s Workforce Management System Aids in Accurate Wage Calculation

Precisely incorporating all these components manually isn’t just time-consuming; it can lead to errors causing discrepancies during payroll processing. This dramatically impacts real average wage calculations within large-scale operations, (defined as retailers with over 500 staff members).

Legion’s WFM solution helps with simplification. By automating calculations while considering every relevant aspect, including region-specific taxation rules alongside your organization-specific overtime policies—our system simplifies what would otherwise be a challenging task.

Importance and Benefits of Calculating Actual Wages

In retail, accurate calculation of actual wages is a fundamental aspect that can significantly impact an organization’s financial health. By leveraging Legion’s Workforce Management Software, businesses gain insights into their labor costs in real time.

Cost Control and Budget Optimization

The precision in wage calculations allows organizations to identify any discrepancies early on, thereby preventing unnecessary expenses such as overtime costs or non-compliance penalties with today’s average hourly wage regulations. This accuracy saves direct cost and aids strategic planning for future expenditures.

A thorough understanding of weekly earnings helps companies allocate resources effectively based on payroll data. The ability to spot areas where they might be overspending or underinvesting enables them to redirect funds toward high-impact sectors driving revenue growth.

Compliance and Fair Compensation

Detailed insights provided by robust systems like Legion Time and Attendance are invaluable when it comes to monitoring uneven wage growth within your company. With this level of detail, HR leaders can detect trends such as widening income inequality among different employee groups before these issues escalate further.

This meticulous approach towards tracking median usual weekly earnings does more than just optimize labor; it paves the way for significant savings, contributing towards overall business expansion.

Employee Engagement and Retention

It’s important to note that this also impacts some of the usually less tangible metrics. Transparent and accurate wage calculations foster trust and fairness within the workforce, positively impacting employee engagement and retention. When employees are confident that their efforts are recognized and appropriately compensated, they are more likely to feel valued and motivated, leading to higher job satisfaction and increased productivity.

Comparing Actual Versus Projected Figures

The art of juxtaposing actual wages with projected figures is a large part of financial management. This comparison acts as an indicator, allowing companies to measure their labor cost efficiency and pinpoint areas for improvement.

The Significance Behind Projected vs. Calculated Figures

Projected vs. calculated figure comparisons are instrumental in understanding wage growth trends and evaluating whether today’s real average wage aligns with budget expectations. For instance, if it’s observed that average wages commonly jumped 7%, but your company’s usual weekly earnings only increased by 5%, this could flag potential issues needing attention.

Beyond identifying discrepancies between expected and realized outcomes, this analysis can reveal uneven wage growth across different departments or organizational roles. These insights empower HR leaders to make informed decisions about raising minimum wages or tweaking compensation strategies to ensure fairness and competitiveness.

Using Comparisons to Optimize Resource Allocation

This comparative exercise also aids in optimizing resource allocation effectively and so fosters a strong labor market environment internally. By reviewing data on how median usual weekly earnings rose against projections, organizations may uncover opportunities for reallocating resources more efficiently.

This practice becomes more important when considering factors like seasonally adjusted current dollars or lagged economists’ expectations which might influence overall payroll budgets.

Using modern workforce management software helps drive sustainable business growth while keeping employee satisfaction levels high without compromising on profitability goals.

Conclusion

Figuring out true wages is more than just doing math; it’s about getting important insights into your business’s fiscal condition.

With Legion’s Time and Attendance software, you’re simplifying the complex process of wage calculation, optimizing budgets, and minimizing unnecessary expenses.

The accuracy in computing wages enhances transparency and contributes significantly to overall savings. It’s a tool that every business needs for effective workforce management.

A comparison between actual versus projected figures allows organizations to assess their performance against set targets. This assessment can lead to better resource allocation and improved operational efficiency.

If you’re ready to unlock the potential of accurate wage computation for your business growth, consider using Legion WFM.

Our innovative workforce management software provides real-time insights into employee earnings while considering all relevant factors, such as overtime, bonuses, or deductions.

With Legion, you have everything you need at your fingertips for efficient labor cost control and strategic decision-making. Start optimizing today with Legion!